Recent market volatility has likely raised fresh doubts with some investors about where the market is headed from here. The S&P 500 and the Dow Jones both fell over 10% in just a few trading days late in August,1 and concerning headlines about growth in China have persisted over the last few weeks (though the market has recovered a bit over that time).

But don’t let the volatility lure you away from your long-term investment strategy. As investors, it’s tempting to experience declines (especially when they happen quickly like in August), and to want to react—to take your portfolio more defensive or to sell out of stocks altogether. It’s human nature, but it can also hurt more than it helps.

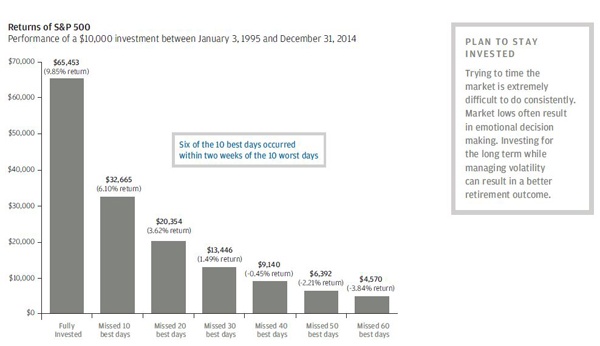

The repercussions of ‘reacting’ can indeed have a significant impact on the investment returns you generate over time. Take a moment to study the chart below. As you can see, with $10,000 invested over 20 years, you would have over $65,000 had you stayed invested even throughout two bear markets. But if you missed just the 10 best days over that time, you would have an eyebrow-raising $30,000 less. That’s more than half of what you could have earned, in just 10 days! Miss the 40 best days, and you actually end up losing money.