How To Protect Your Financial Information Online

You’ve worked hard to save and plan for a healthy financial future. Unfortunately, cybercriminals are also hard at work — devising ways to steal your...

2 min read

Doug Hutchinson

:

Mar 14, 2024 3:46:57 PM

Doug Hutchinson

:

Mar 14, 2024 3:46:57 PM

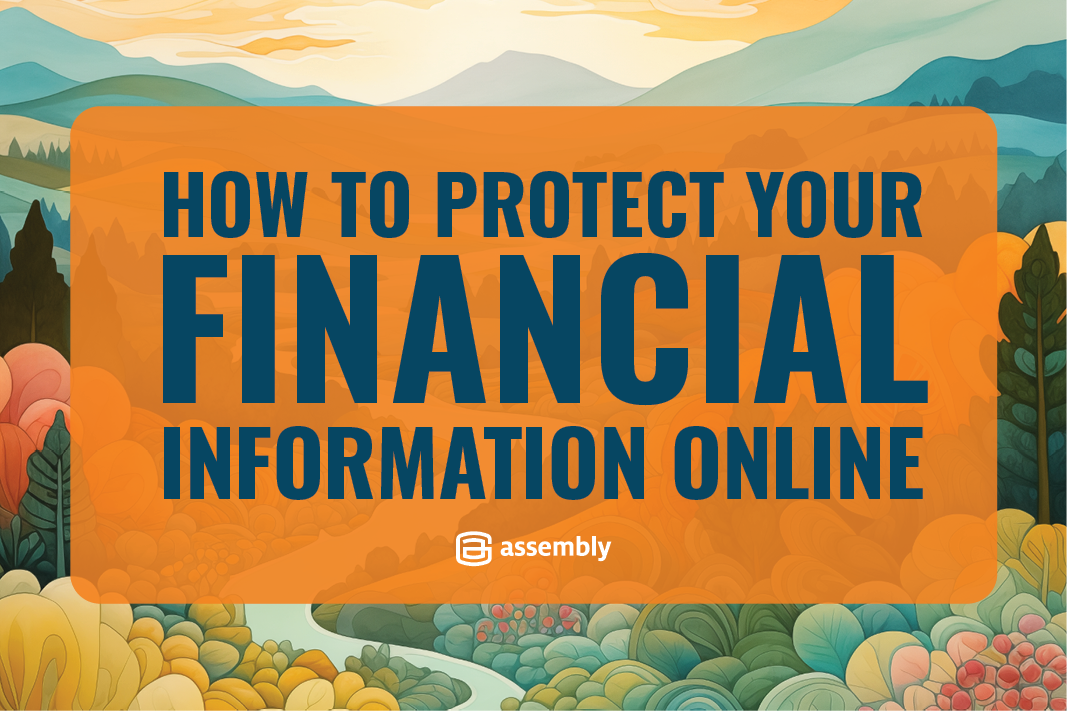

With US equity markets trading near all-time highs1, some investors may be concerned about a sell-off in the near future. While this thinking may make sense intuitively (after all, every bear market started from a market peak), record highs typically lead to continued market strength.

If you don’t feel comfortable investing when the market is high, here are a few things to consider:

Research from JPMorgan 2 shows: if you invested in the S&P 500 at every all-time market high since 1970:

Interestingly, JPMorgan’s research also showed that if you invested on any given day since 1970, your average return a year later would be 9%. Remember that if you only invested when the market was at an all-time high, your average return a year later would be 9.4%. In other words, investing at market peaks delivered a slightly higher return after 12 months compared to investing on a random day.

To be fair, a market high can be followed by a market sell-off (see 2007, which was followed by the 2008 Great Financial Crisis). But more often than not, a new all-time high is a stepping stone to additional all-time highs.

The chart below from JPMorgan shows there have been 673 days in which the S&P 500 reached a new all-time high from 1991 to 2023.3 That’s an average of more than 20 times per year. However, as shown below, new market highs tend to cluster together during periods of prolonged market strength.

New heights in the equity market shouldn’t necessarily trigger any specific trading action in your portfolio, but they can be an opportunity to rebalance your portfolio. For example, a portfolio of 60% equities and 40% bonds and cash may have drifted off target — assuming the equities in the portfolio have outperformed the bonds and cash in the portfolio during the market upswing.

With US equity markets near all-time highs, some investors may feel tempted to wait for a meaningful pullback before making new investments. However, that significant market correction may never materialize. Investors who haven’t put money to work will have missed an opportunity to increase their wealth. As described above, market strength tends to beget further market strength. Investing at an all-time market high typically leads to higher returns a year later than investing on a random day.

All that said, stock investments should be based on your short and long-term goals, not the ebb and flow of the market. An experienced financial advisor can help you develop and execute a strategy to meet your needs.

Market corrections are an unavoidable part of investing in equities. Reaching an all-time high should not be a cause for panic and should not be interpreted as a signal to sell equities.

Disciplined investors should maintain a long-term view of the market and avoid adjusting investments every time the market moves higher or lower (micromanaging their portfolio).

Investors should work closely with their Wealth Manager to understand the tax implications of a portfolio rebalance in a taxable account.

Questions? Contact us for a free consultation. At Assembly Wealth, we're passionate about helping you create a purpose-driven future filled with peace, happiness, and fulfillment.

1 CNBC Stock Market Today Feb 12, 2024

2 New year nerves: Why we’re still optimistic: JP Morgan

3 JPMorgan Guide to the Markets – Extra Slides as of 12-31-23, Page 9

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client or prospective client’s investment portfolio. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Fill out the form to be notified about new articles.

You’ve worked hard to save and plan for a healthy financial future. Unfortunately, cybercriminals are also hard at work — devising ways to steal your...

When we talk with clients about saving and investing for the future, the conversation usually steers toward retirement planning – IRAs, 401(k)s,...

There’s no such thing as a one-size-fits-all financial strategy. A solution that works for someone with a diverse portfolio won’t be a good fit for...